Market

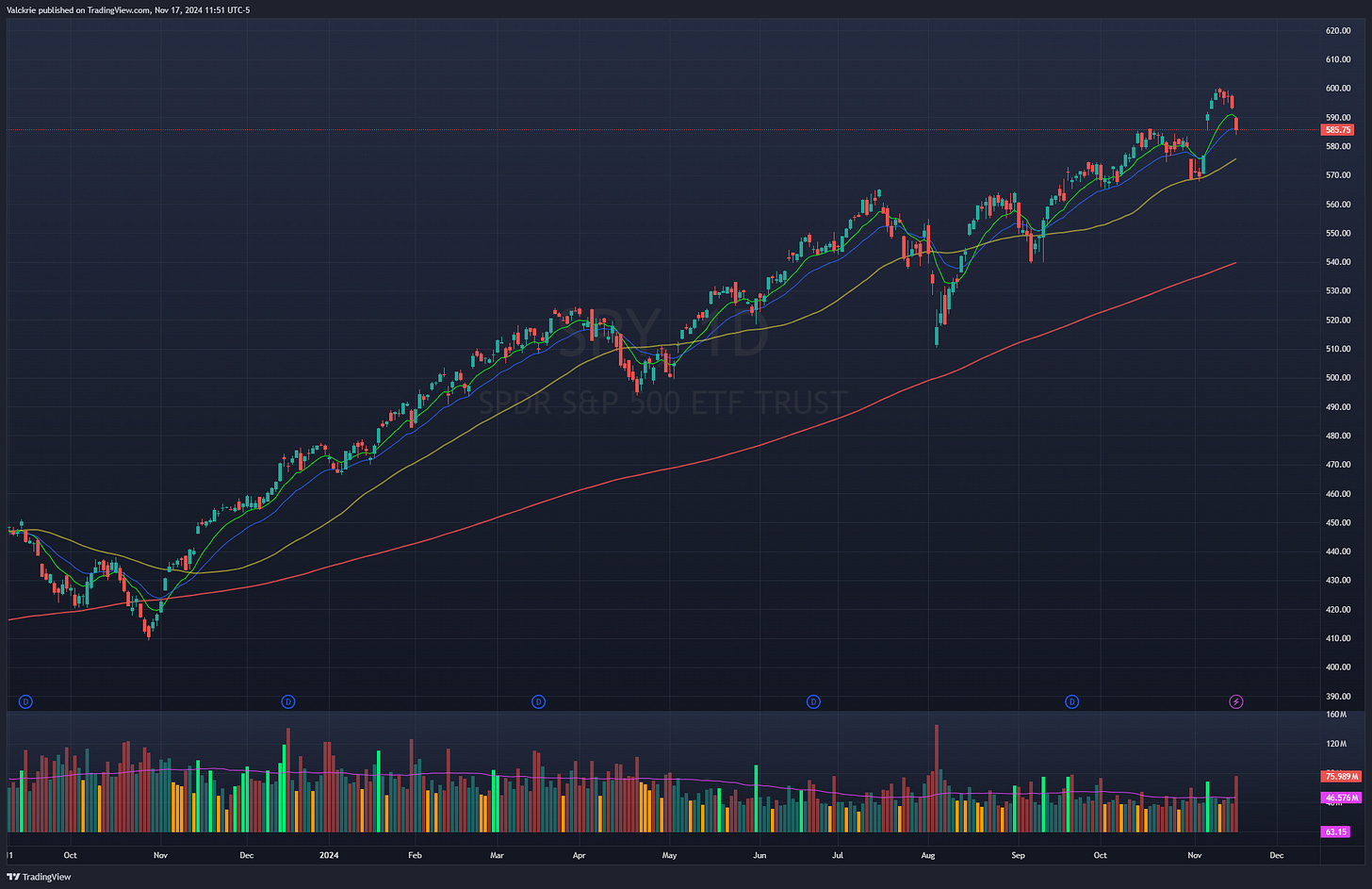

All major indices gapped down on Friday and sold off throughout the day. There was a small end of day rally but overall still closed weak. Price is now in the gap from election night. We remain in an uptrend as the last higher low sits around $568 on SPY 0.00%↑ where it held the 50MA before the election.

Crypto

Despite the selloff BTC held up and is demonstrating clear relative strength. It is currently consolidating around the $90k area for multiple days.

Over the weekend Solana broke out over a consolidation range and is nearing all time highs

Below is a ratio chart that may signal a potential SOL outperformance phase

Solana related altcoins

RAY “Raydium is an automated market maker (AMM) and liquidity provider built on the Solana blockchain for the Serum decentralized exchange (DEX).”

JUP “Jupiter is a decentralized exchange (DEX) aggregator that allows users to swap tokens at optimal prices with low slippage and transaction ...”

Memes

WIF BONK BOME POPCAT PONKE

Stocks

COIN 0.00%↑ a clear crypto beneficiary that rallied strongly post election. High correlation to BTC movement. Pulled back midweek to successfully retest the $270-$280 region which was recent breakout area. Strong daily uptrend and had relative strength on Friday when market sold off.

HOOD 0.00%↑ another brokerage firm that will benefit hugely from increased crypto trading activity. Barely pulled back this week with decreasing volume. Also demonstrating relative strength, didn’t sell off with market much and couldn’t even fill the gap to $30.70. $34 area is the breakout level from this recent consolidation which should lead to a good swing hold

SQ 0.00%↑ recent earnings mover mentioned in last weeks post. Also has some BTC exposure and is in the payments space which is a strong sector. Zooming out this looks like a breakout into a stage 2 uptrend from a multiyear base. Recent pullback was on declining low volume. Look to join trend for a swing trade and eventual $90 breakout

AFRM 0.00%↑ strong sector in the payments space also making new 52 week highs. Relative strength to market.

UPST 0.00%↑ Big rally on earnings day, low volume pullback all the way to the gap level $65 and held for now. Clear risk spot for entry to see if it can continue trend up

MARA 0.00%↑ Bitcoin miner, can make big moves in a strong BTC uptrend. Pulled back and held the gap area around $19-$20. Breaking out from a 3 month base

CORZ 0.00%↑ another BTC miner, low volume pullback on daily showing strength

BE 0.00%↑ “Bloom Energy Announces 1 GW Fuel Cell Deal With AEP, Providing Clean Power For AI Data Centers” Huge move on this news, providing energy for data centers has been a big theme lately. Watching if it can digest and offer a setup to move higher

VST 0.00%↑ the 2nd highest gainer in the S&P500 this year only losing to PLTR 0.00%↑. Low volume daily pullback post earnings, swing setup to join trend

NVDA 0.00%↑ reports earnings this week and will likely be a market moving event

XBI 0.00%↑ sold off hugely in the last few days after Robert F Kennedy Jr was nominated lead the Department of Health and Human Services (HHS). The selloff was the worst day since the 2022 bottom. On watch for a mean reversion bounce but will depend on the price action this week

SMCI 0.00%↑ “Super Micro Computer to file plan on Monday to remain listed on Nasdaq” - been in a heavy downtrend since the auditor resignation news as funds scramble to exit the stock. The news could offer a short term relief bounce

RKLB 0.00%↑ reported earnings and had two days of profit taking (idea from this post) but has since managed to rally again. The space sector is strong right now PL 0.00%↑ LUNR 0.00%↑ ASTS 0.00%↑