Market

QQQ 0.00%↑ made a new low on Thursday but recovered on Friday, currently looking like a 50MA shakeout

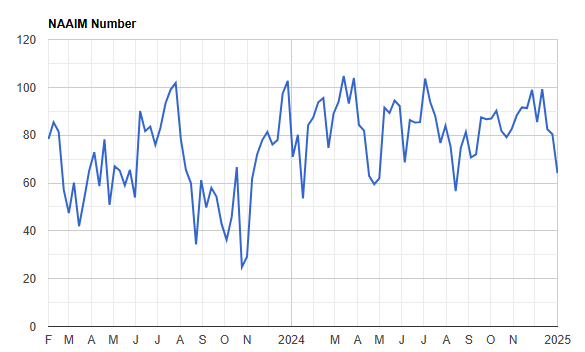

NAAIM exposure index dropped sharply (read more here)

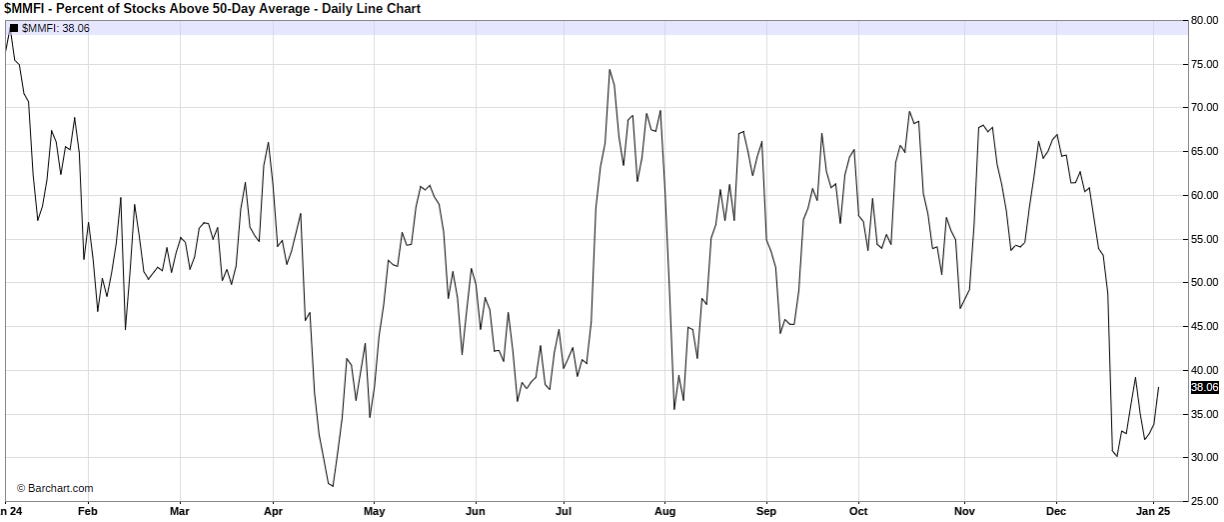

% stocks above 50-Day moving average dropped sharply since the FOMC selloff. Friday breadth was strong and could be start of a recovery

Crypto

$BTC pullback held support around $92k and briefly traded under the 50MA. Potential to see a higher low above $92k and a break of $100k

COIN 0.00%↑ over 30% pullback from highs and looks to have held retest of this prior $260 resistance area. Another rally and it will reclaim the 50MA

BTDR 0.00%↑ strongest bitcoin mining stock compared to the others in the basket

RUM 0.00%↑ recently received a $775 million investment from Tether. Pulling back after initial rally and starting to turn if it holds

RIOT 0.00%↑ reclaiming big level around $11 support

Semiconductors

SMH 0.00%↑ has been consolidating sideways since last July. Has been supported multiple times at the 200-Day moving average. Friday showed signs of strength and a breakout from this range could signal semis resuming leadership in the market

“Microsoft to Spend $80 Billion on Datacenters This Year” - other hyperscalers expected to spend similar amounts, likely means strong earnings from chipmakers

NVDA 0.00%↑ broke out on Friday - Jensen Huang will be Keynote Speaker at the CES (Consumer Electronics Show) 2025 on Jan 6th

TSM 0.00%↑ near all time higher breakout level

POET 0.00%↑ smallcap semi name in a consistent uptrend

SMTC 0.00%↑ midcap semi consolidating after earnings

Power

Nuclear Power/Energy stocks started moving last week based on this CEG 0.00%↑ news - “Constellation Energy (CEG) announced a 10-year, $840 million contract with the U.S. General Services Administration to supply power to facilities of more than 13 government agencies”

GEV 0.00%↑ consolidation range at highs after a huge rally and little giveback

OKLO 0.00%↑ broke out on Friday. Still has $28 level to clear through

NNE 0.00%↑ $30 level is the breakout area

Misc.

ANF 0.00%↑ big winner from last year which has been consolidating since July. Over $160 breakout could start trending again

GEO 0.00%↑ Trump trade, rallied after election and holding up. Possible $30 breakout for a run into inauguration

APP 0.00%↑ another winner from last year. However Software stocks may not be the current leading group

Robotics

Robotic stocks are emerging as a new sector theme

KITT 0.00%↑ RR 0.00%↑ SERV 0.00%↑ IRBT 0.00%↑

Other mentions

Quantum computing stocks are still trending: RGTI 0.00%↑ IONQ 0.00%↑ QUBT 0.00%↑ QBTS 0.00%↑ QMCO 0.00%↑ ARQQ 0.00%↑

EVTOL (electric vertical take-off and landing): JOBY 0.00%↑ ACHR 0.00%↑ BLDE 0.00%↑ EVTL 0.00%↑ SRFM 0.00%↑

Batteries: ABAT 0.00%↑ QS 0.00%↑ SLDP 0.00%↑ ENVX 0.00%↑ MVST 0.00%↑

Thanks as always 🙏🏼

Good scan, thanks for the share🤜🤛