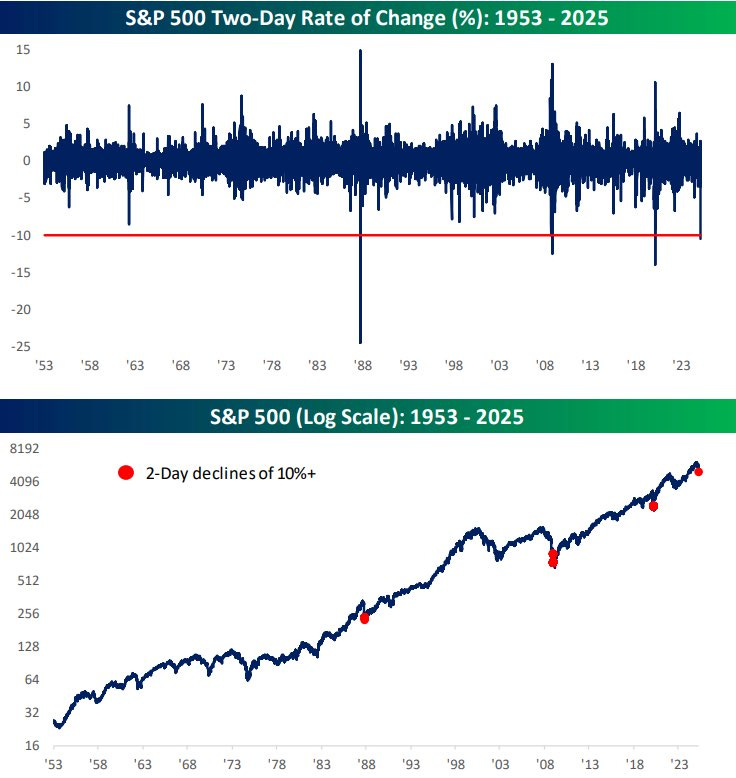

After Liberation Day last week, SPY 0.00%↑ suffered one of the fastest and largest declines in history. Many breadth and sentiment indicators are at extremes. When volatility is this high the situation can change fast on a daily basis, so it is vital to be open minded and nimble. The obvious trade that many traders are watching for this week is a mean reversion bounce in the market. Headlines continue to develop over the weekend as countries negotiate trade deals, which will influence where the market opens on Monday. The best scenario would be a gap down to stretch the band further, while a gap up could prove trickier.

Market bounce

Possible vehicles to express the long trade:

BAC 0.00%↑ JPM 0.00%↑ banks

TSM 0.00%↑ SOXL 0.00%↑ AMD 0.00%↑ NVDA 0.00%↑ for semiconductors

VXX 0.00%↑ once the market turns, short volatility

Relative strength

$BTC did not make a new low last week despite the market selloff. Whether it holds up during the weekend or finally breaks down by Monday open is yet to be seen

Also notable that MSTR 0.00%↑ closed positive on Friday after undercutting lows in the morning. Again, either this is showing strength or BTC breaks and so does MSTR

XHB 0.00%↑ homebuilders sector also closed positive on Friday

RKT 0.00%↑ a fintech company that provides home ownership related services, also is a strong chart

AFRM 0.00%↑ closed higher than it opened on Friday

TSLA 0.00%↑ did not make a new low during last weeks selloff. If the market gaps down its possible that TSLA holds the double bottom area around 220

Tariff related stocks

LULU 0.00%↑ NKE 0.00%↑ W 0.00%↑ RH 0.00%↑ these stocks sold off on the extremely high tariff rate outlined for Vietnam. However on Friday there was news that Vietnam was ready to negotiate 0% tariffs and these stocks bounced