QQQ 0.00%↑ low volume holiday week, closing with an inside weekly bar, as well as an inside day on Thursday. Looking for short term direction if we trade to either side of Wednesday—Thursday’s trading range. Medium term direction we are still trading within a wider range of the reversal day lows and the record gain day highs (400 ~ 468). Most popular tech stocks are still trading pretty correlated with the market, if the market rallies, buy the stocks with relative strength (e.g. PLTR 0.00%↑) and if the market drifts lower, short the relative weak stocks (e.g. SMCI 0.00%↑)

VXX 0.00%↑ similar look to indices, looking for volatility to fade if market rallies

GLD 0.00%↑ no trend reversal in gold yet but will be observing if the trend starts to speed up for any exaggerated moves up

NFLX 0.00%↑ positive reactions on earnings report in afterhours

TSLA 0.00%↑ reporting earnings on Tuesday

HTZ 0.00%↑ with a 100% rally in the last two days after Bill Ackman reported a 19.8% stake in the company

DJT 0.00%↑ rallied on Thursday after the company sent a complaint to federal regulators, citing potential market manipulation involving its stock

BULL 0.00%↑ strong rally after IPO last week. Has since faded for the last few days. Bounce potential if it gaps down and sells off further

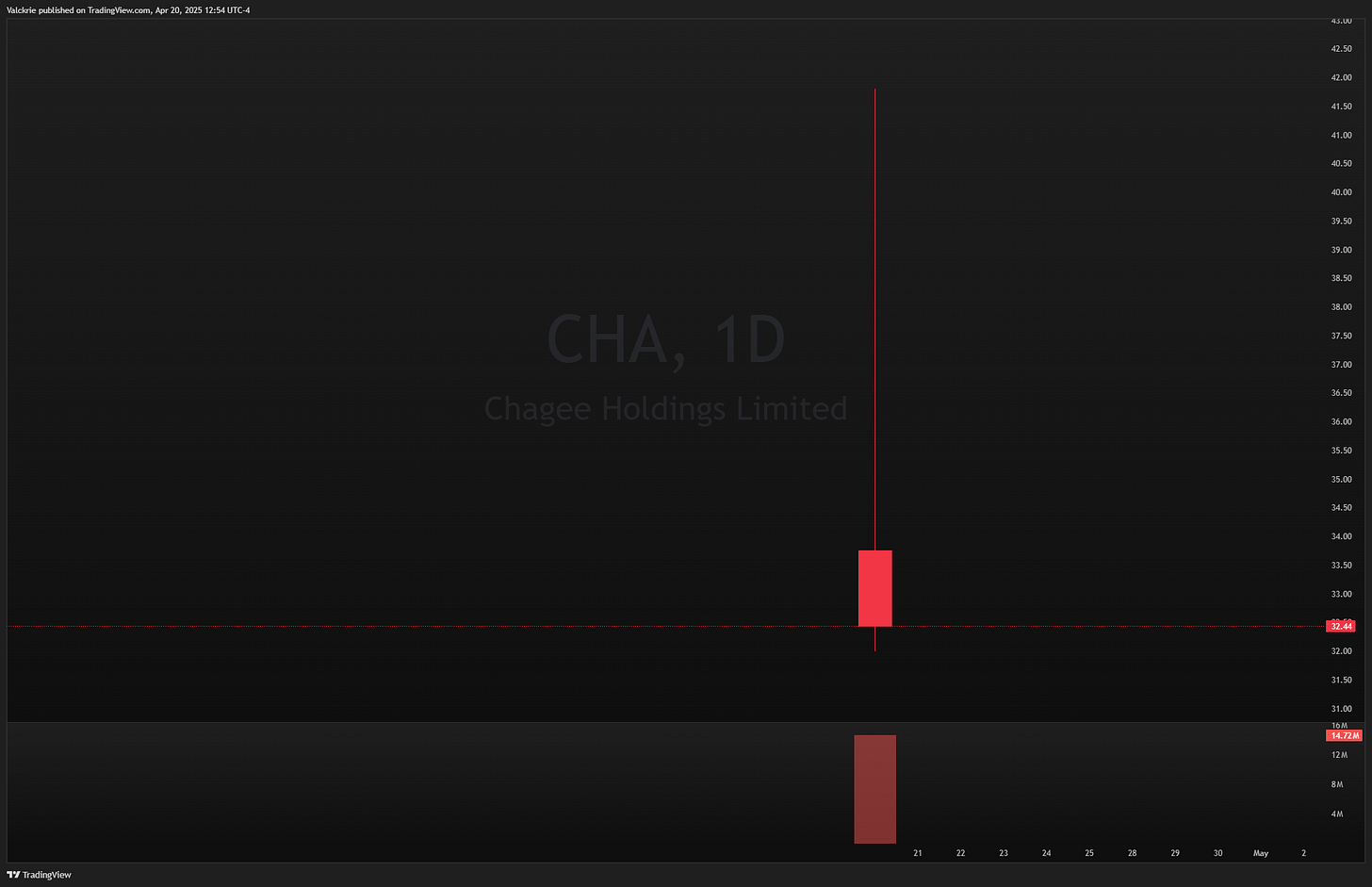

CHA 0.00%↑ new IPO from Thursday - a Chinese company that operates milk tea chain stores

$BTC MSTR 0.00%↑ currently remain one of the stronger stocks technically as it is above the 50 MA and 200 SMA

DLTR 0.00%↑ highest close in the last 6 month range. XLP 0.00%↑ staples outperforming XLY 0.00%↑ discretionary currently