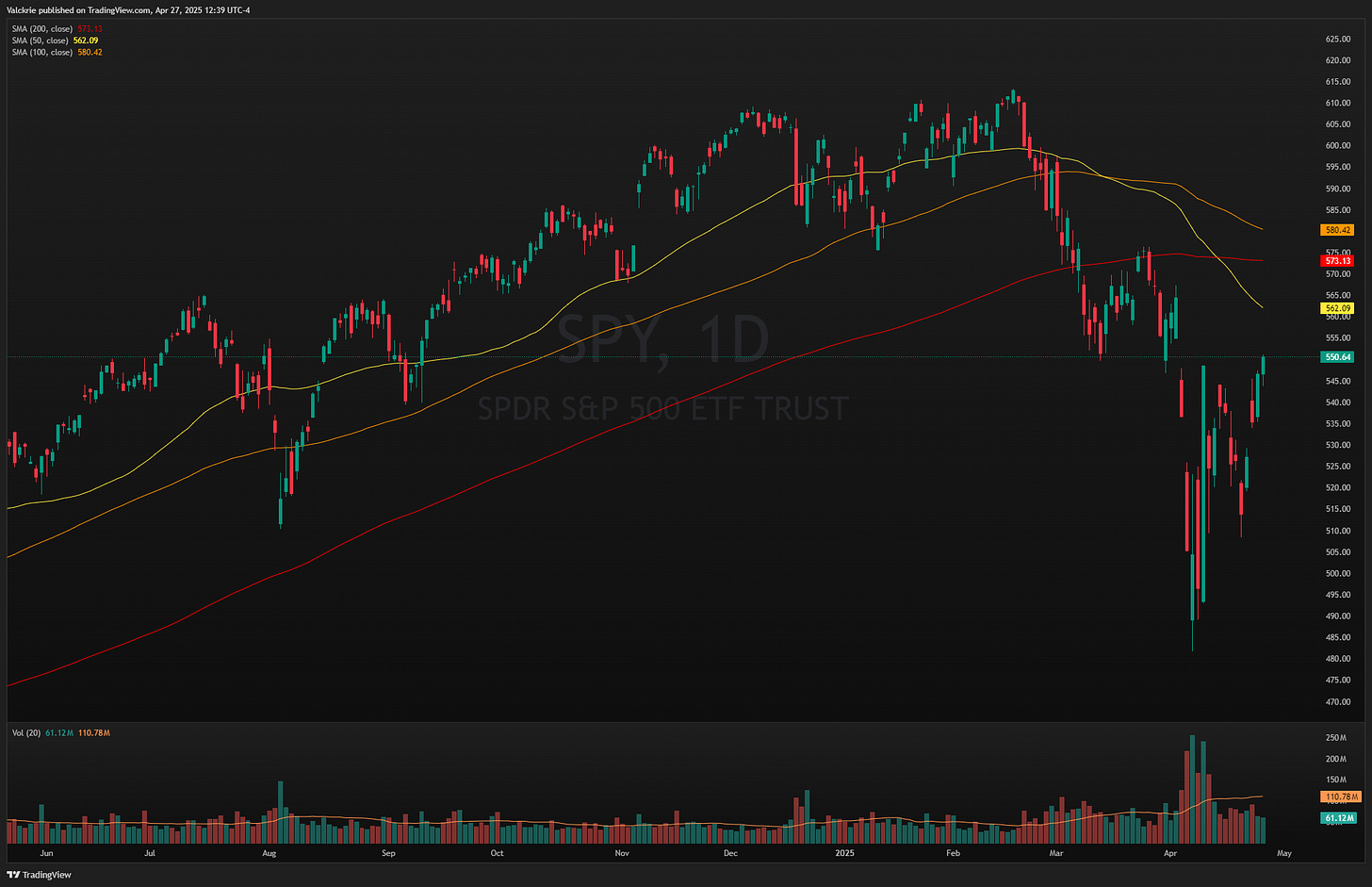

SPY 0.00%↑ closed with strong week, breaking above the last 2 weeks range and above the highs of Wednesday 9th April (the huge rally day when Trump announced 90 day pause on tarriffs). Some technical levels to watch are the $555 liberation day gapfill area, as well as the declining 50 MA and 200 MA on the daily. Price is also entering the prior consolidation zone between 550-565, it seems likely the market can take a pause here after being up 1% every day this week.

PLTR 0.00%↑ is a clear relative strength stock vs the market, remains in an uptrend and above all moving averages, made a higher high before the market, and is only 10% off all time highs. A potential scenario is an exhaustion move into the 115-120 zone and reversal, if the market also takes a pause

HOOD 0.00%↑ also a strong stock, nearing the $50 key level and daily pivot for a higher high break. Could see a breakout over 50, or if market pauses, fall trade back into range with 50 acting as resistance

NVDA 0.00%↑ remains a relatively weak stock vs the market. One of the few names that did not break over the highs of the big Wednesday

TSLA 0.00%↑ had a very bad earnings report this week but broke out of the earnings day high on Friday. Price is nearing the 200 MA and also prior daily resistance from earlier in March. Depending on the market could see a breakout from this pivot or reject resistance and fall back into range

DJT 0.00%↑ has been rallying for a few days after some fluff news last week. After a failed push into the 200 MA on Friday, want to see if a break of daily bar low can start a downtrend

IONQ 0.00%↑ was halted for news on Friday which turned out to be “IonQ announces $22M deal to develop quantum innovation center with EPB”. After a short lived price spike it closed weak with a large wick on the daily candle. Given the lackluster reaction on news if the market turns down would look for a short, price also rejected the declining 100 MA

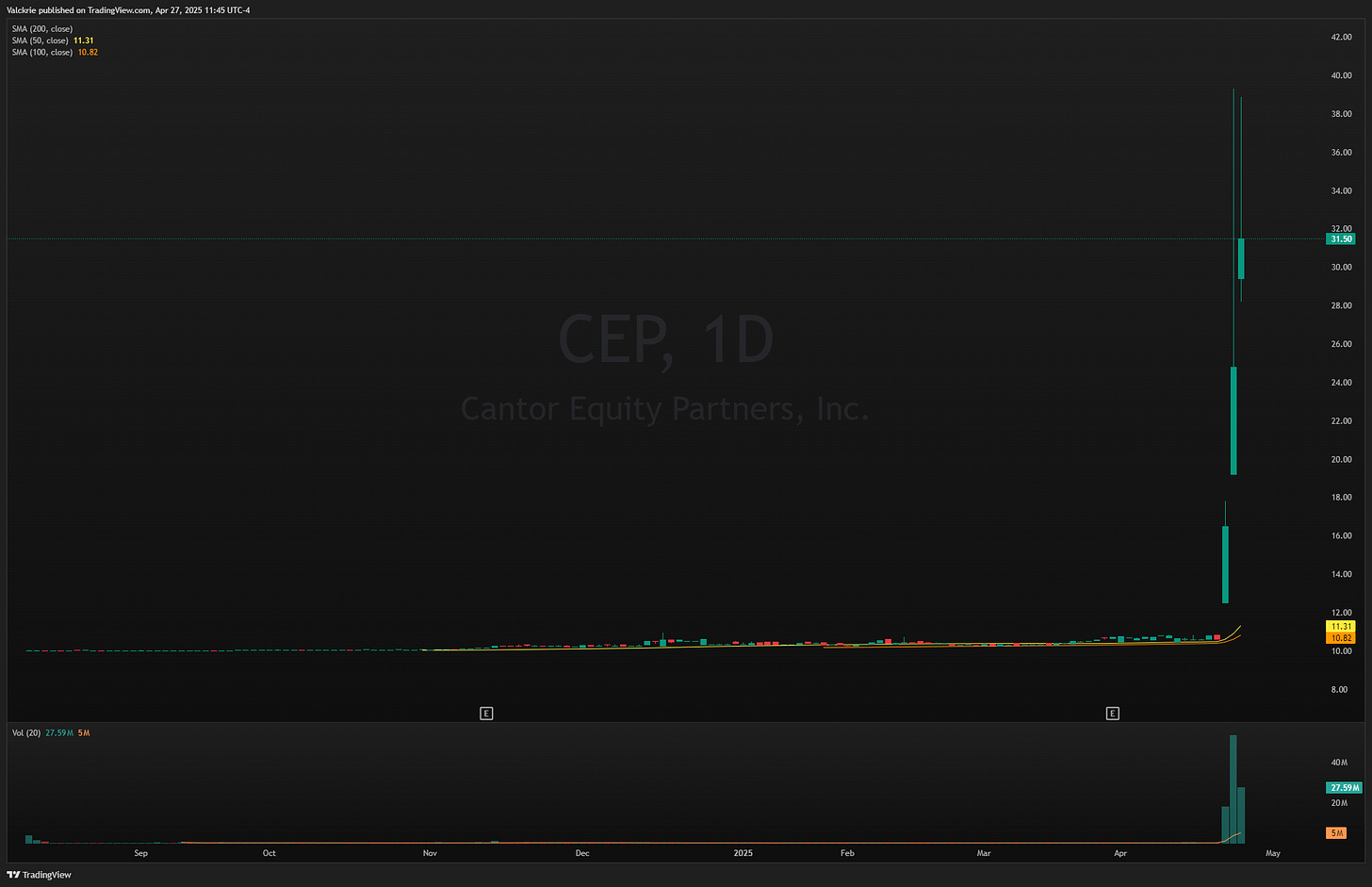

CEP 0.00%↑ Bitcoin proxy stocks are a hot theme currently: “Merger with newly formed Bitcoin-focused firm Twenty One. Valued at $3.6 billion, the combined entity will become the third-largest public holder of Bitcoin, trailing only MicroStrategy and Tether.”

UPXI 0.00%↑ “Upexi Secures Massive $100M Investment to Build Solana Treasury”

GLD 0.00%↑ Gold likely formed an exhaustion top last week. It has been consolidating the last few days and could be a lower high before slowly retesting lower prices, 3200 or the 50 MA

$BTC had a strong rally this week but made a big move into the $95,000 area, a highly traded zone from the last few months and looks to have stalled into resistance. If BTC pulls back would trade MSTR 0.00%↑ and COIN 0.00%↑ along with it